Florida House to begin work on property tax overhaul – after shelving DeSantis ideas

With a Florida House committee taking its first steps toward overhauling how much Floridians pay in property taxes, “everything is on the table,” the panel’s co-chair said.

But what is not in play is what Gov. Ron DeSantis has touted.

Rep. Toby Oberdorf, R-Palm City, said that when lawmakers gather at the Capitol later this month for the initial meetings of the House Select Committee on Property Taxes, there will be no discussion of a complete wipe-out of property taxes, nor of tax relief involving direct payments to homeowners from state funds.

Still, “there’s a whole host of items that we’re reviewing and looking at,” Oberdorf said.

The 37-member bipartisan committee is set to hold its first hearings Sept. 22-23 at the Capitol. It was formed last spring when the Legislature ended the 2025 regular session without reaching agreement on how to approach property tax cuts, which DeSantis was pushing hard.

Legislative leaders were wary, especially House Speaker Daniel Perez, R-Miami, who clashed with the governor on a range of issues. Forming the property tax committee was seen as a concession to placate DeSantis – for a while.

The panel, though, is expected to work off-and-on through at least the end of the year to come up with a proposed constitutional amendment for the November 2026 ballot that could include changes to how property taxes are calculated, collected or spent.

The amendment would have to be approved by at least 60% of Florida voters to become law.

DeSantis has called for such a ballot measure. But the governor also earlier pitched a quick-turn response of spending $5 billion in state money on $1,000 checks as a rebate to homeowners – an idea lawmakers dismissed.

Any talk of cutting property taxes, though, is touchy with local governments which rely on them.

“We are working to educate legislators and citizens on how counties function, what they do and where their revenues come from and where investments are made,” said Cragin Mosteller, a spokeswoman for the Florida Association of Counties.

Ballot measure is end goal

Going into its first hearings before the 2026 session, set to begin in January, the House property tax committee appears intent on crafting a ballot measure that covers a lot of ground.

But lawmakers are looking for something reasonable, Oberdorf said: “Whatever policy we wind up doing has to keep in mind that Miami-Dade County is very different from Liberty County or Baker County.”

No state has eliminated property taxes and in Florida, they are the biggest source of dollars for 51 of 67 counties and almost half of the state’s 411 cities.

More than $55 billion in property taxes flowed to counties, cities, school boards and Florida’s special districts last year – more than double what was collected in 2014. It’s 46% higher than the amount taken in statewide just four years ago, state records show.

Property tax part of Florida since 1839: Florida Gov. DeSantis targets ‘bloated’ local budgets in property tax slash push

DOGE visits come with harsh words: DeSantis' new DOGE audits put cities, counties under state scrutiny

Oberdorf said key concepts his committee will be working on include increasing the state’s homestead tax exemption, now $50,000 for most homeowners on their primary residences, to a much higher level. Also, possibly boosting the portability amounts used in determining taxable value under the state’s Save Our Homes law is an idea that will be reviewed.

“We’re hearing from a lot of constituents that people are feeling trapped in their homes again, because of taxes. They have an unwillingness to sell,” he added.

Break with DeSantis is downplayed

The co-chair also downplayed any sharp division with DeSantis, even though the committee has no plans to pursue what the governor has promoted.

“We continue to have conservations back and forth with executive team members,” Oberdorf said.

DeSantis has spent weeks deriding property taxes as basically defying the idea of actual home ownership.

What the governor has said he’d like to see as a constitutional amendment has ranged from total elimination of property taxes to erasing or at least deeply cutting the taxes on Floridians’ primary homes.

Just like with his latest call for eliminating school vaccination requirements, DeSantis appears to reject the concept of supporting community well-being through mandates, including property taxes, which finance police, fire and other government services.

“You buy a home, you own it outright, free and clear, and yet you have to continue to pony up money to the government, just for the courtesy of using your own property,” DeSantis said during an appearance earlier this year.

DeSantis has a 'vision'

In Orlando on Sept. 2, DeSantis laid out what he described as his “vision.” It began with, “Your personal home, we really believe, should not be subject to tax,” he said.

He then likened home ownership to car ownership, suggesting it should be taxed at “point of sale,” but then, apparently, maybe never again.

DeSantis also this summer dispatched state Chief Financial Officer Blaise Ingoglia, his appointment to that Cabinet post in July. Ingoglia’s office has been conducting audits of a handful of mostly Democratic-leaning cities and counties to ferret out what the administration condemns as questionable spending.

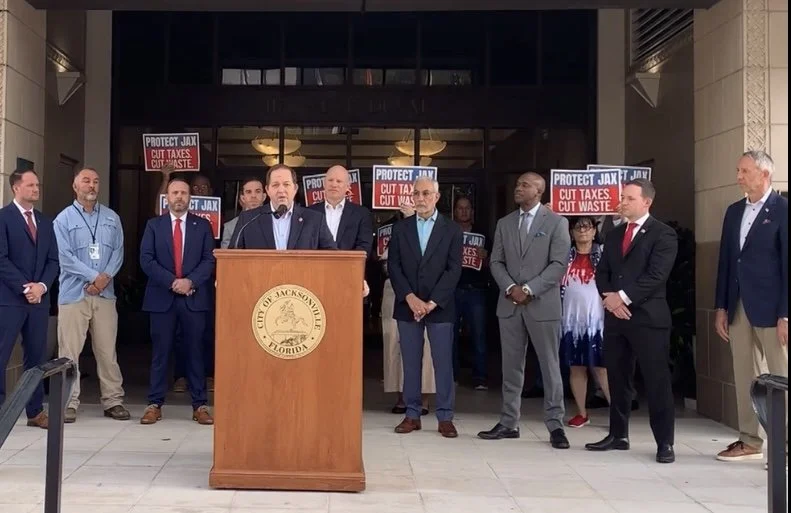

Ingoglia tends to arrive in these city halls and county buildings amid theatrics and flame-throwing rhetoric about local officials wasting taxpayers’ dollars. His auditors are expected to issue reports in coming months about their findings and any negatives revealed are certain to bolster the drive for cutting property taxes.

The data collected as part of these reviews will be available to the House select committee.

Other ideas in play

Among other areas Oberdorf said the committee will examine are how property appraisals are conducted from county-to-county, a bid to gauge any disparities across the state.

Still another idea will likely center on providing tax relief for people who inherit a home or property from a deceased relative.

Others include expanding the property tax exemptions for disabled military veterans and to rein-in the tax increases local governments can impose on non-homesteaded properties, mostly rentals and commercial space.